All Categories

Featured

Table of Contents

- – How does Exclusive Real Estate Deals For Accre...

- – Why is Residential Real Estate For Accredited ...

- – What is the best way to compare High-return R...

- – Are there budget-friendly Private Real Estate...

- – What is the process for investing in Private...

- – Who offers the best Accredited Investor Prop...

Rehabbing a house is thought about an energetic financial investment strategy. On the various other hand, passive real estate investing is terrific for investors who desire to take a much less engaged technique.

With these methods, you can delight in easy income with time while allowing your investments to be handled by somebody else (such as a residential property management firm). The only point to keep in mind is that you can shed out on a few of your returns by employing somebody else to take care of the investment.

An additional consideration to make when picking a real estate investing approach is direct vs. indirect. Straight financial investments entail really buying or handling properties, while indirect techniques are much less hands on. Several capitalists can obtain so captured up in identifying a residential property kind that they don't know where to begin when it comes to locating a real home.

How does Exclusive Real Estate Deals For Accredited Investors work for high-net-worth individuals?

There are loads of residential properties on the marketplace that fly under the radar due to the fact that capitalists and buyers don't know where to look. Several of these residential properties suffer from inadequate or non-existent marketing, while others are overpriced when noted and as a result failed to receive any interest. This means that those capitalists happy to sort via the MLS can discover a variety of investment chances.

By doing this, investors can continually track or look out to new listings in their target location. For those asking yourself how to make links with real estate agents in their respective areas, it is a good idea to participate in neighborhood networking or realty occasion. Capitalists browsing for FSBOs will certainly likewise discover it beneficial to deal with a property agent.

Why is Residential Real Estate For Accredited Investors a good choice for accredited investors?

Capitalists can likewise drive with their target locations, trying to find signs to locate these homes. Bear in mind, identifying residential or commercial properties can take time, and capitalists should prepare to utilize multiple angles to protect their next bargain. For financiers staying in oversaturated markets, off-market buildings can stand for a possibility to be successful of the competition.

When it comes to looking for off-market buildings, there are a few resources capitalists should check. These include public documents, real estate public auctions, wholesalers, networking events, and contractors.

What is the best way to compare High-return Real Estate Deals For Accredited Investors options?

Years of backlogged repossessions and enhanced motivation for financial institutions to reclaim can leave also much more repossessions up for grabs in the coming months. Financiers searching for foreclosures should pay cautious attention to newspaper listings and public documents to find potential residential properties.

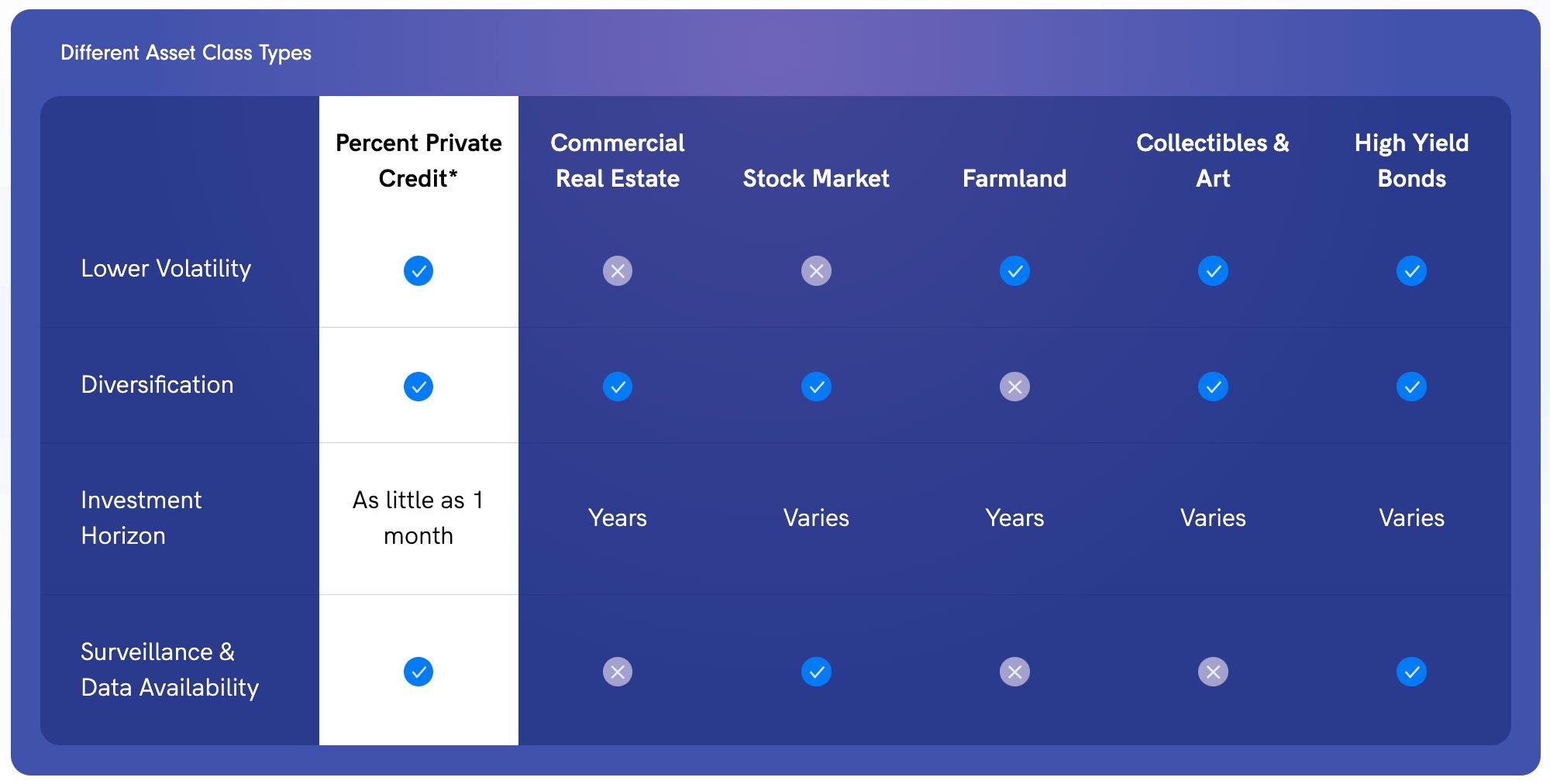

You ought to take into consideration investing in property after learning the numerous benefits this asset needs to offer. Historically, genuine estate has actually executed well as an asset class. It has a positive partnership with gdp (GDP), indicating as the economic situation expands so does the need for actual estate. Usually, the consistent need offers genuine estate reduced volatility when contrasted to other investment types.

Are there budget-friendly Private Real Estate Deals For Accredited Investors options?

The factor for this is since property has low relationship to various other investment types thus supplying some defenses to capitalists with various other possession kinds. Various kinds of property investing are related to various levels of danger, so make certain to locate the appropriate financial investment approach for your objectives.

The process of acquiring property entails making a deposit and funding the remainder of the sale rate. Therefore, you only spend for a little percentage of the building in advance but you control the entire financial investment. This type of utilize is not available with other financial investment types, and can be made use of to additional grow your investment portfolio.

Nevertheless, due to the wide array of alternatives available, numerous financiers likely locate themselves questioning what truly is the most effective property investment. While this is a simple inquiry, it does not have an easy response. The very best type of financial investment property will certainly rely on numerous variables, and capitalists ought to beware not to eliminate any type of choices when browsing for prospective deals.

This write-up checks out the opportunities for non-accredited capitalists aiming to venture into the rewarding realm of realty (Passive Real Estate Income for Accredited Investors). We will explore numerous financial investment opportunities, governing considerations, and approaches that encourage non-accredited people to harness the possibility of real estate in their investment profiles. We will certainly additionally highlight exactly how non-accredited investors can function to become certified investors

What is the process for investing in Private Real Estate Investments For Accredited Investors?

These are normally high-net-worth individuals or firms that fulfill certification demands to trade personal, riskier investments. Revenue Criteria: People need to have an annual earnings going beyond $200,000 for two consecutive years, or $300,000 when integrated with a partner. Web Worth Requirement: A total assets exceeding $1 million, leaving out the key residence's value.

Financial investment Knowledge: A clear understanding and awareness of the threats associated with the financial investments they are accessing. Documentation: Ability to provide economic statements or other documentation to validate revenue and internet worth when requested. Real Estate Syndications need recognized investors due to the fact that sponsors can only permit accredited investors to sign up for their financial investment chances.

Who offers the best Accredited Investor Property Portfolios opportunities?

The initial typical false impression is as soon as you're a certified financier, you can keep that standing indefinitely. Accreditation lasts for five years and must be resubmitted for approval upon that target date. The 2nd false impression is that you need to hit both financial benchmarks. To come to be a certified financier, one have to either hit the earnings standards or have the total assets requirement.

REITs are eye-catching due to the fact that they produce more powerful payouts than conventional stocks on the S&P 500. High return returns Profile diversification High liquidity Rewards are exhausted as ordinary income Level of sensitivity to passion prices Risks connected with particular buildings Crowdfunding is an approach of on-line fundraising that entails asking for the public to contribute money or startup funding for new projects.

This allows entrepreneurs to pitch their ideas straight to everyday internet customers. Crowdfunding uses the capability for non-accredited capitalists to come to be investors in a firm or in a realty residential or commercial property they would certainly not have actually had the ability to have access to without certification. One more advantage of crowdfunding is profile diversification.

The third advantage is that there is a reduced obstacle to entrance. In many cases, the minimum is $1,000 bucks to spend in a firm. Oftentimes, the financial investment applicant needs to have a track record and remains in the infancy phase of their task. This could indicate a higher threat of losing an investment.

Table of Contents

- – How does Exclusive Real Estate Deals For Accre...

- – Why is Residential Real Estate For Accredited ...

- – What is the best way to compare High-return R...

- – Are there budget-friendly Private Real Estate...

- – What is the process for investing in Private...

- – Who offers the best Accredited Investor Prop...

Latest Posts

Tax Land Sales

Excess Funds

Government Real Estate Tax Auctions

More

Latest Posts

Tax Land Sales

Excess Funds

Government Real Estate Tax Auctions